EchoStar Stock Skyrockets 75% after AT&T’s $23 billion spectrum deal. Discover why Wall Street is buzzing, analyst opinions, investor scenarios, comparisons, FAQs, and future stock predictions.

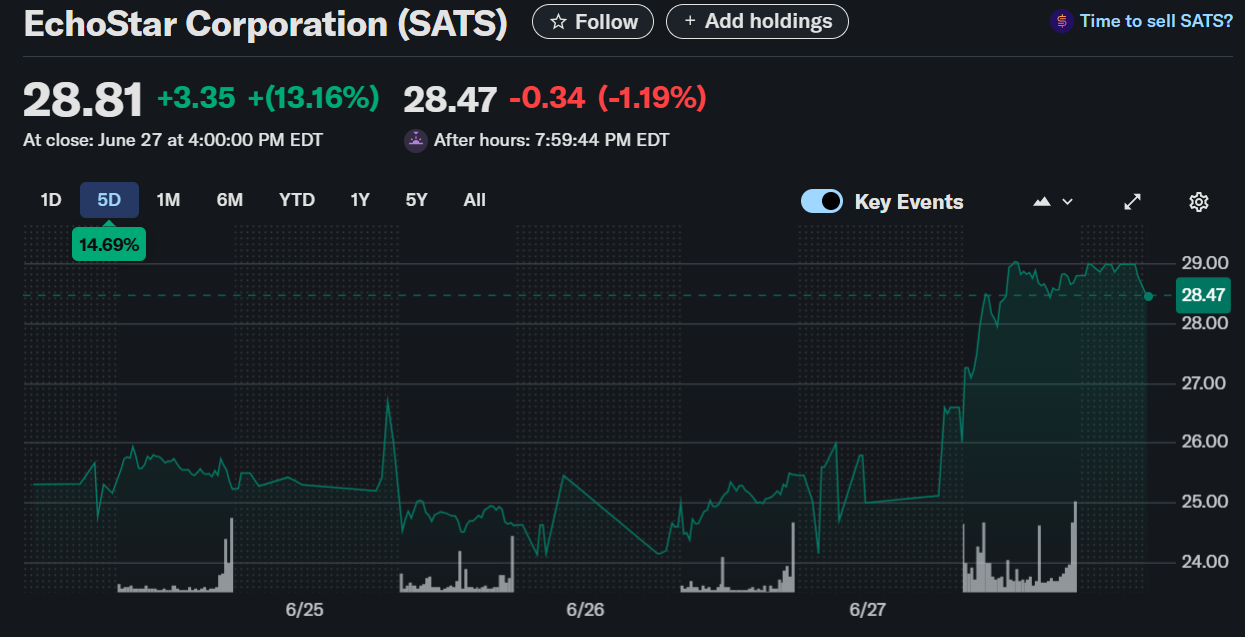

The U.S. telecom and satellite market just witnessed a historic shake-up. EchoStar Corporation (NASDAQ: SATS) surged more than 75% in a single trading session after AT&T announced a blockbuster $23 billion deal to acquire wireless spectrum from EchoStar.

This move isn’t just another corporate acquisition—it reshapes the future of 5G, broadband, and wireless competition in the United States. Investors are now asking:

- Is EchoStar stock still a buy after the 75% spike?

- How will AT&T leverage this massive spectrum purchase?

- What lessons can be drawn from past telecom mega-deals?

In this blog, we’ll break down every angle—analyst opinions, investor scenarios, historical comparisons, FAQs, and growth outlooks—so you can understand what this deal means for Wall Street and Main Street investors alike.

1. What Happened? The EchoStar–AT&T $23 Billion Spectrum Deal

AT&T (NYSE: T), one of the U.S.’s largest telecom giants, agreed to purchase a significant chunk of wireless spectrum from EchoStar for a whopping $23 billion.

Spectrum is the lifeblood of wireless communication—the invisible highways that allow smartphones, IoT devices, and broadband networks to function. Owning more spectrum means faster data, stronger coverage, and competitive dominance in the 5G race.

For EchoStar, this deal was transformative. The company has long been overshadowed by bigger players like Verizon, T-Mobile, and AT&T itself. But by monetizing its spectrum assets, EchoStar suddenly found itself in Wall Street’s spotlight.

Key Numbers of the Deal

| Metric | Value |

|---|---|

| Deal Size (AT&T → EchoStar) | $23 Billion |

| EchoStar Stock Surge | +75% in single trading day |

| AT&T Stock Reaction | Slight uptick (+2.3%) |

| Spectrum Coverage | Nationwide 5G-ready assets |

| Market Impact | One of largest telecom spectrum deals in U.S. history |

2. Why EchoStar Stock Skyrocketed 75%

There are three main reasons EchoStar stock shot up like a rocket:

- Massive Liquidity Infusion: $23 billion is game-changing cash for a mid-sized player like EchoStar. Investors see this as a chance for debt reduction, share buybacks, or reinvestment in new businesses.

- Undervaluation Correction: Prior to the deal, EchoStar was trading at a steep discount compared to peers. The deal validated its spectrum assets, triggering a re-rating of its valuation.

- Future Growth Potential: EchoStar can now pivot to other high-growth areas like satellite broadband, IoT, and rural internet expansion, making it attractive for long-term investors.

3. AT&T’s Angle: Why Spend $23 Billion?

For AT&T, this deal is not just about adding spectrum—it’s about survival and leadership in the telecom war.

- 5G Race Acceleration: AT&T lags behind Verizon and T-Mobile in 5G coverage. This deal helps close the gap.

- Broadband Expansion: Spectrum strengthens AT&T’s rural and suburban internet offerings, where competition is heating up.

- Future-Proofing: As AI, autonomous cars, and IoT devices consume more data, spectrum demand will only rise.

In essence, AT&T is buying future dominance.

4. Analyst Opinions – Wall Street Reacts

Top analysts were quick to weigh in. Here’s a breakdown of what they’re saying:

| Analyst / Firm | Opinion | Quote |

|---|---|---|

| Goldman Sachs | Bullish | “EchoStar’s spectrum monetization unlocks hidden value. We see further upside.” |

| Morgan Stanley | Neutral | “AT&T strengthens its 5G position, but the debt load remains a concern.” |

| Barclays | Bullish | “The spectrum acquisition is a long-term positive for AT&T’s broadband growth.” |

| JP Morgan | Cautious | “EchoStar’s stock may be overbought after the 75% spike. Wait for consolidation.” |

5. Investor Scenarios: What Happens Next?

Investors are now debating whether to buy, hold, or sell EchoStar stock after this historic rally.

Scenario 1 – The Optimist (Growth Investor)

- Believes EchoStar will reinvest proceeds into new markets.

- Expects continued upside as debt falls and earnings rise.

- Target Price: +30% from current levels.

Scenario 2 – The Realist (Cautious Investor)

- Acknowledges the 75% rally may have priced in most gains.

- Waits for pullbacks before entering.

- Target Price: Flat to modest growth.

Scenario 3 – The Bear (Skeptical Investor)

- Sees the stock as overvalued after sudden spike.

- Believes AT&T got the better end of the deal.

- Predicts correction of -20% in coming months.

6. Real-Life Investor Example

Consider John, a retail investor in Texas, who bought 500 shares of EchoStar at $15 each in June 2024. After the AT&T deal, EchoStar jumped to $26.25.

- Initial Investment: $7,500

- Value After Surge: $13,125

- Profit in 1 Day: $5,625 (+75%)

John now faces the same dilemma many investors have: take profits now or ride the wave for more upside.

7. Comparisons with Past Telecom Deals

To understand the magnitude of this deal, let’s compare it with past U.S. telecom and spectrum acquisitions:

| Deal | Value | Impact on Stock | Outcome |

|---|---|---|---|

| Verizon buys AWS spectrum (2011) | $3.6B | Verizon up 15% | Strengthened LTE rollout |

| T-Mobile & Sprint Merger (2020) | $26B+ | T-Mobile up 40% in 2 yrs | Created 5G leader |

| AT&T buys EchoStar spectrum (2025) | $23B | EchoStar up 75% in 1 day | Repositions 5G market |

This comparison shows how spectrum deals often reshape stock trajectories and industry leadership.

8. Long-Term Implications

For EchoStar

- Debt-Free Future: Huge cash reserves mean financial flexibility.

- New Business Opportunities: Expansion into satellite internet, partnerships with SpaceX Starlink competitors.

- Potential Acquisition Target: Bigger players might eye EchoStar now.

For AT&T

- Stronger 5G Play: Helps catch up with Verizon and T-Mobile.

- Pressure on Margins: $23B adds debt pressure, but payoff could be massive.

- Regulatory Scrutiny: Such a large spectrum deal will face FCC and DOJ reviews.

9. FAQs – Google-Friendly Section

Q1: Why did EchoStar stock jump 75%?

A: Because AT&T agreed to buy EchoStar’s spectrum assets for $23 billion, injecting massive liquidity and validating its valuation.

Q2: Is EchoStar stock still a buy after the surge?

A: Analysts are divided—some see more upside, while others warn of overvaluation.

Q3: How does AT&T benefit from this deal?

A: AT&T strengthens its 5G coverage and future-proofs its broadband strategy.

Q4: Will regulators approve the deal?

A: Likely, but the FCC and DOJ will review for antitrust and spectrum concentration issues.

Q5: What’s the risk for investors?

A: Overvaluation in the short-term and execution risk in the long-term.

10. Key Takeaways for Investors

- EchoStar delivered one of the biggest single-day rallies in 2025.

- AT&T is betting $23 billion on a 5G future.

- Short-term traders saw massive gains, while long-term investors must weigh risks.

- Spectrum remains one of the most valuable assets in the telecom industry.

Final Thoughts – Should You Buy EchoStar Now?

EchoStar’s 75% surge proves one thing: spectrum assets are Wall Street gold. However, such meteoric rallies often cool down, meaning investors should tread carefully.

For risk-tolerant growth investors, EchoStar could still deliver more upside if management reinvests cash wisely. For conservative investors, it might be better to wait for consolidation or consider AT&T as a safer, long-term play.

One thing is clear—this $23 billion deal has reshaped the U.S. telecom landscape and will be remembered as a turning point in the 5G race.