SaaS marketplace NowPurchase has completed its first-ever employee stock option plan (ESOP) buyback, benefitting 40 employees to cash out their vested stock options

The buyback was valued at around 100X the initial purchase price

ESOP programme was initially launched in July 2019

SaaS marketplace NowPurchase has completed its first-ever employee stock option plan (ESOP) buyback.

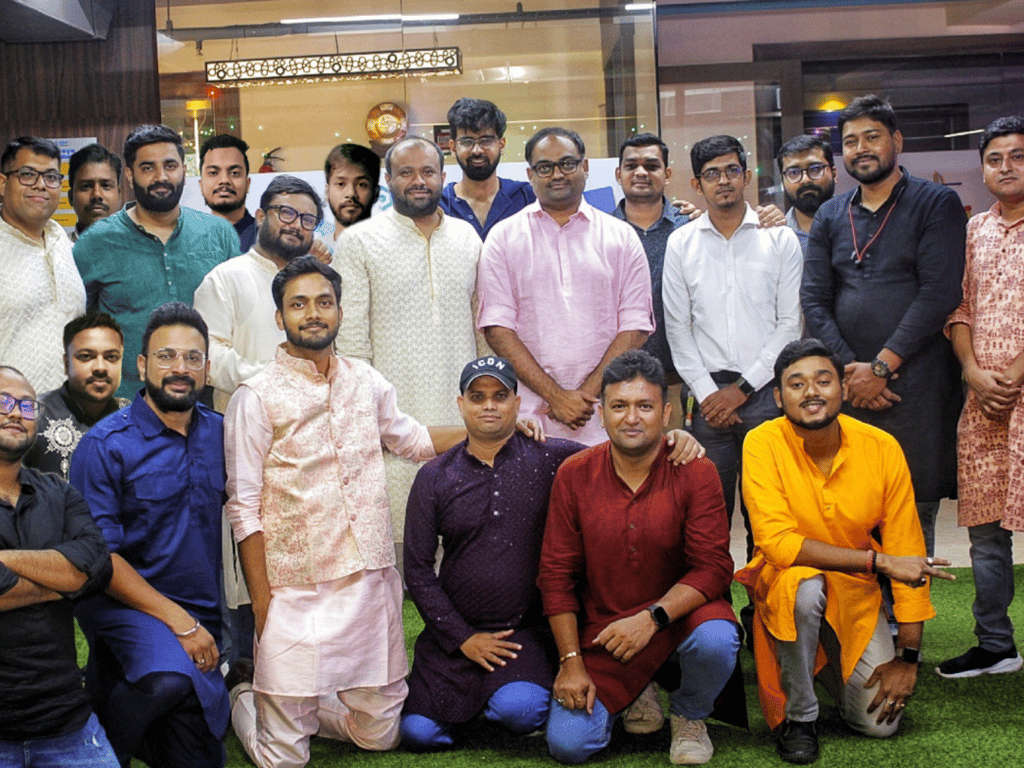

Naman Shah, founder and chief executive of the company, told Inc42 that through this buyback option, 40 of its employees took the opportunity to cash out a portion of their vested stock options in the company, while the rest chose to hold their shares.

Although the company did not disclose the financial terms of the ESOP, but said that the buyback was valued at around 100X the initial purchase price.

The ESOP programme was initially launched in July 2019.

Founded in 2017 by Naman and Aakash Shah, NowPurchase procures raw materials through its scrap recycling services and metal cloud platform to benefit metal manufacturers. It also provides its users with a WhatsApp bot to discover prices and stock in real time, a team to provide on-ground service and quality assurance, and a proprietary SaaS platform to optimise their manufacturing process.

NowPurchase said in a statement that the ESOP buyback exemplifies its commitment to building a world class team that reaps benefits of their hard work and are key shareholders of their company.

“The fact that this buyback included employees across all functions —warehouse staff, potential CXOs, and everyone in between—highlights our commitment to growth and value creation for all. This wouldn’t have been possible without the support of our first institutional investors Orios & InfoEdge,” Naman Shah said.

The Kolkata-based company previously raised $6 Mn (around INR 50 Cr), in September, in a mix of equity and debt infusion from a host of investors, to deploy the fresh proceeds for expansion and rolling out new solutions to better serve the metal manufacturing industry.

On that note, Shah now confirmed, operations would be live by the end of this month in the states of Punjab, Rajasthan and Tamil Nadu.

This development comes at a time when nearly 20 startups in India have announced ESOP buybacks this year, providing their employees an opportunity to swell their pockets.

For instance, Bengaluru-based AppsForBharat, earlier this month, rolled out its first buyback programme for employee stock ownership plan (ESOP) worth around INR 2.1 Cr, benefitting 25 employees to cash out their stock options in the company.

Additionally, Google-backed edtech startup Adda247’s first buyback option announced in July, benefitting at least 130 employees across different roles and functions.

Furthermore, Peak XV-backed agritech startup DeHaat completed its first-ever employee stock ownership plan (ESOP) buyback programme worth INR 10 Cr, in June, where its 153 team members were benefited.